Ways to Give

Westwood Land Trust (“WLT”) is a 501(c)(3) public charity. Contributions to WLT are eligible for charitable income, estate and gift tax deductions to the fullest extent allowed. Individuals and corporations should consult their tax advisors, since specific tax benefits may vary depending upon circumstances and AGI limitations.

1. Online

Tax ID number: 04-3477793

The Donate button below will take you to our PayPal Giving Fund page where you may make a tax-deductible donation.

2. Check

Make the check payable to Westwood Land Trust, P.O. Box 2616, Westwood, MA 02090

3. Donor Advised Fund (DAF)

When processing a DAF grant through a charitable giving account, search for WLT by tax ID (04-3477793)

4. Matching Gift

Double your donation! Complete your company’s online process or send paper matching forms with your check or online donation receipt to Westwood Land Trust, Inc., PO Box 2616, Westwood, MA 02090.

5. Stock Donations

When you donate appreciated securities, both the gift amount and charitable deduction are the fair market value of the stock, and there is no capital gains tax. Call WLT’s President at 617-697-5671 to discuss the process.

6. IRA Donations

Make a tax-free gift to WLT directly from your IRA. IRA distributions are exempt from taxable income and qualify for the Required Minimum Distribution (RMD). You must be age 70 ½ or older. Contact your IRA administrator to request a charitable gift transfer to WLT.

7. Volunteer Opportunities

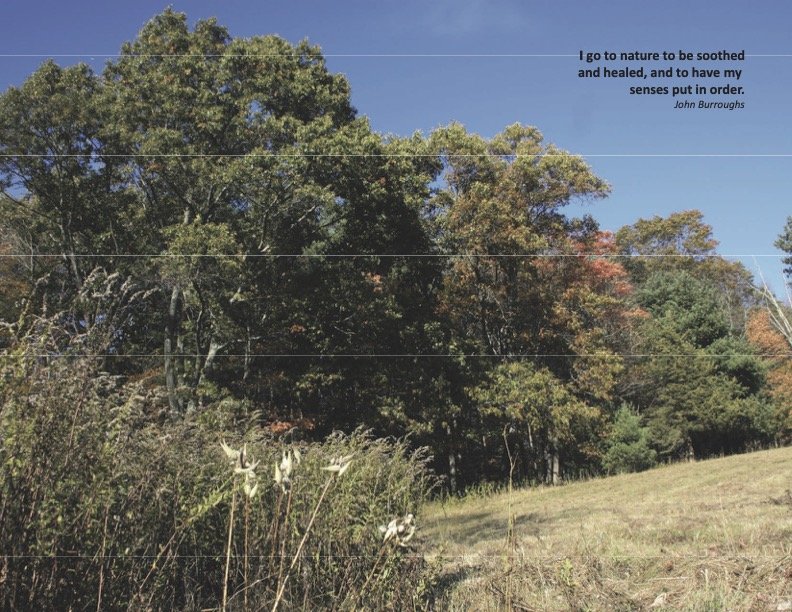

There are many ways to volunteer with Westwood Land Trust, from helping with our Earth Week cleanup to monitoring properties to taking seasonal photographs of properties protected by WLT.

Please contact westwoodlandtrust@gmail.com for more details.